March 1, 2020

Life is full of ups and downs, and the same can be said about the financial markets. In particular, the Dow Jones Industrial Average and the S&P 500, the two most closely watched benchmarks for publicly traded companies in the United States. When the ups and downs are more pronounced, many media outlets dramatize the events using overexuberant verbiage, voiceovers, graphics and attention-grabbing headlines. Under the guise of keeping us informed, overabundance is often sold on the upside and scarcity on the downside. Both lead to fear-based planning which rarely ends well.

Corporations in the United States are maybe the most highly evolved creatures on Earth. They adapt quickly, efficiently and are laser focused on the future. While each triggering event that causes the markets to move is different, our investing playbook is very similar or the same. We hold steadfast that owning some of the best companies in the world through diversified stock funds, whether the market is up or down, is one of the only ways to fully capture the continuous growth of human innovation and ingenuity.

To vigorously protect and pursue our long-term visions and goals, we must maintain a high level of awareness and make peace with the reality and frequency of the ups and downs that come along with investing. If we can, the short-term discomfort of such occurrences will begin to soften and investing equanimity will set in making for a much smoother and enjoyable experience and better outcomes.

We believe the journey to financial independence should be freeing and fun, full of variety and vibrancy. After all, we are designing, implementing and working a plan to pursue and sustain the quality of life we desire for ourselves and our family for a lifetime. Let’s simplify the story and allow the historical facts to speak for themselves. As we do, a framework to make wise long-term decisions illuminates our path forward.

Remain Calm

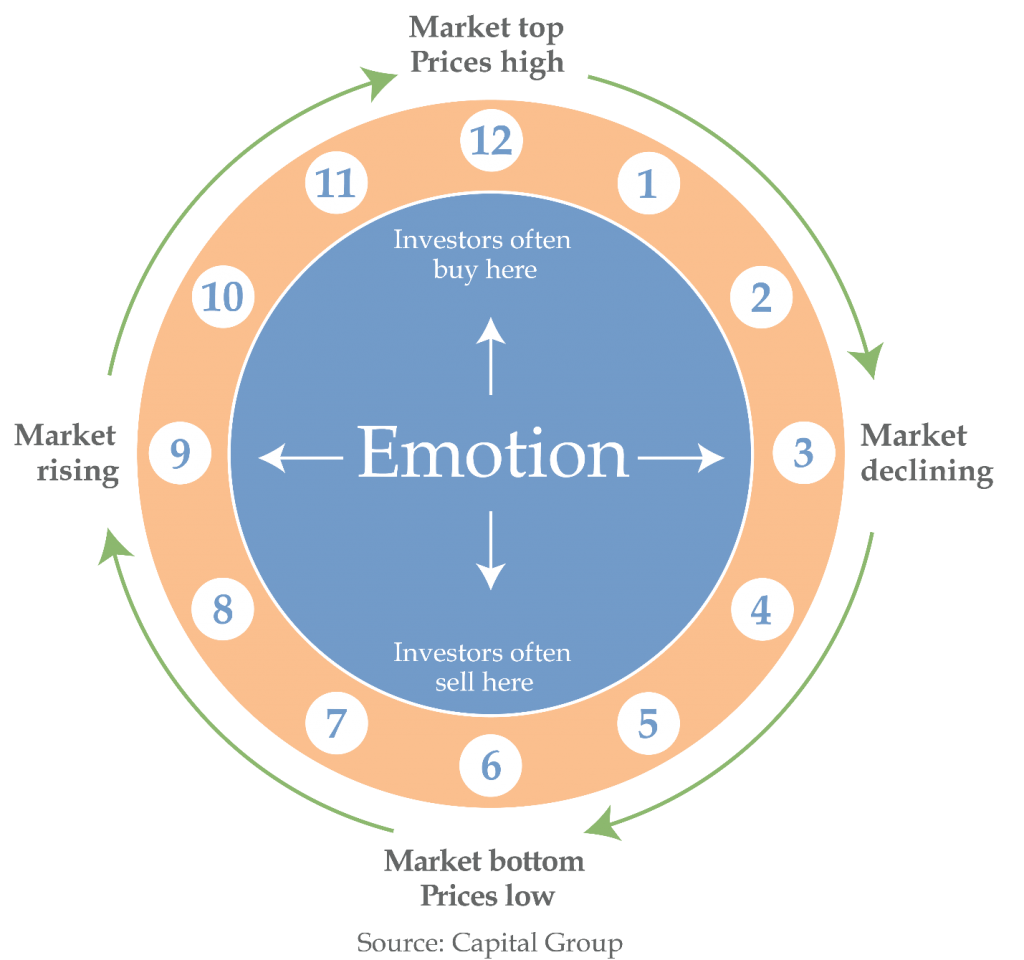

For over three decades, Alan McSmith has served as a wilderness guide exploring the African country and encouraging a deeper, meaningful connection with nature and people. As you can imagine, his line of work leads him into uncomfortable and unpredictable situations. Through education, experience and time-tested principles, he has trained himself to remain calm in the face of uncertainty. Though our environments are very different, we employ many of the same tools. Our vision and goal is to not get euphoric at market peaks, panic in the valleys or get overly emotional in between. We choose to remain calm, stay focused on what matters most, control what we can control and let what we can’t control help get us to the promised land over time. This is a sustainable path to living abundantly.

Video used with permission: With over 30 years of trail and safari guiding experience in several African countries, TEDx speaker Alan McSmith works as a wilderness guide, tracker and elephant conservationist. The video is authentic and demonstrates the unique intelligence and sentiency of these remarkable animals, as well as the connection we share. With a deeper understanding of elephant, as well as our own wild natures, a transformation view of natural leadership emerges. Elephant, after all, may come in various disguises; they may come in the form of your boss, your employees, your spouse or family, a challenge, and obstacle or even an opportunity. Natural leadership is about a a quiet interpretation of these, and how to translate them into meaningful personal and professional encounters. Visit www.alanmcsmith.com for more information.

Be Patient

Buy low, sell high. It’s so easy to say yet so hard to do. For lack of clairvoyance, we will, most likely, not buy at the bottom and sell at the top. Thankfully, neither is a prerequisite to becoming a successful accumulator of wealth. Our experience suggests that we are 90% of the way there by controlling three factors: having a plan, our mix of owning stocks vs. bonds and managing our investing equanimity. Notice investment results are not mentioned as one of the top three reasons. They tend to take care of themselves over time if the right foundation is set to pursue our unique visions and goals from the beginning. Good outcomes are built by working a plan and being patient over time. Great outcomes are built by working a plan and being patient over a lifetime.

The market is the most efficient mechanism anywhere in the world for transferring wealth from impatient to patient people.

Warren Buffett

Ups and Downs Are Normal

The basic premise of financial markets is that everyone has the same information and investments will be bought and sold at their exact, fair price at all times. As new information is made available, prices will adjust accordingly dependent upon what investors are willing to pay at any given time. Certainly, dislocations from this idea happen, both on the upside and downside, allowing astute investors to take advantage of such occurrences. In the end, markets do not make or lose money. People make or lose money.

The two main indexes that are most often linked to stock investments are the Dow Jones Industrial Average, referred to as the DOW, and the S&P 500. The DOW started in 1896 and consists of 30 large, publicly owned companies housed in the United States. The S&P 500 is a broader, more diverse index that consists of 500 large companies in the United States. Though their results are not identical, similar conclusions can be derived by reviewing each one respectively.

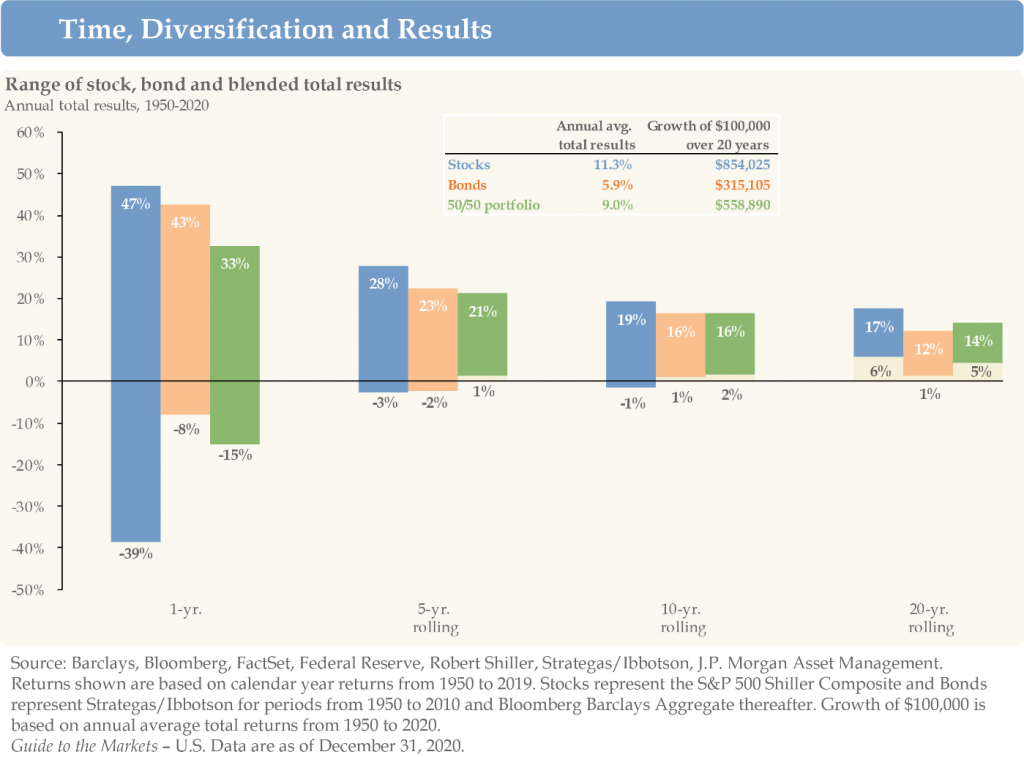

The graphic below follows the 1, 5, 10 and 20-year rolling average periods from 1950-2020 of stocks, bonds and a portfolio of 50% stocks/50% bonds. For example, the far right, 20-year rolling column encompasses 20-year increments starting in 1950. The first 20-year period was from 1950 to 1970, then 1951-1971, 1952-1972, and so on, all the way to 2020. The best 20-year period for stocks, represented in blue, from 1950-2020 enjoyed results of 17% per year with 6% per year, rounded up to the nearest percent, being the gain over the leanest 20-year period. Notice the cone shape pattern that comes to light as your eyes move from left to right starting with the top and bottom of the 1-year bars and ending with the 20-year bars. The longer our timeframe, the better our downside is protected and the less ups and downs we experience investing in stocks and bonds.

The long-term historical results reflect that ownership in the best companies in the world through diversified stock funds is one of the best ways to accumulate wealth over an extended period of time.

Stock funds, as measured by the DOW and S&P 500, have been positive roughly 75% of the time when viewed on an annual basis. They have also enjoyed long-term results that are almost double of bonds. To earn the historically superior results stock funds have provided, we must be willing to accept short-term pullbacks and stay invested for the potential of longer-term rewards. At times, this can be easier said than done, but it is necessary to be a successful accumulator of wealth over time when owning growth-oriented investments.

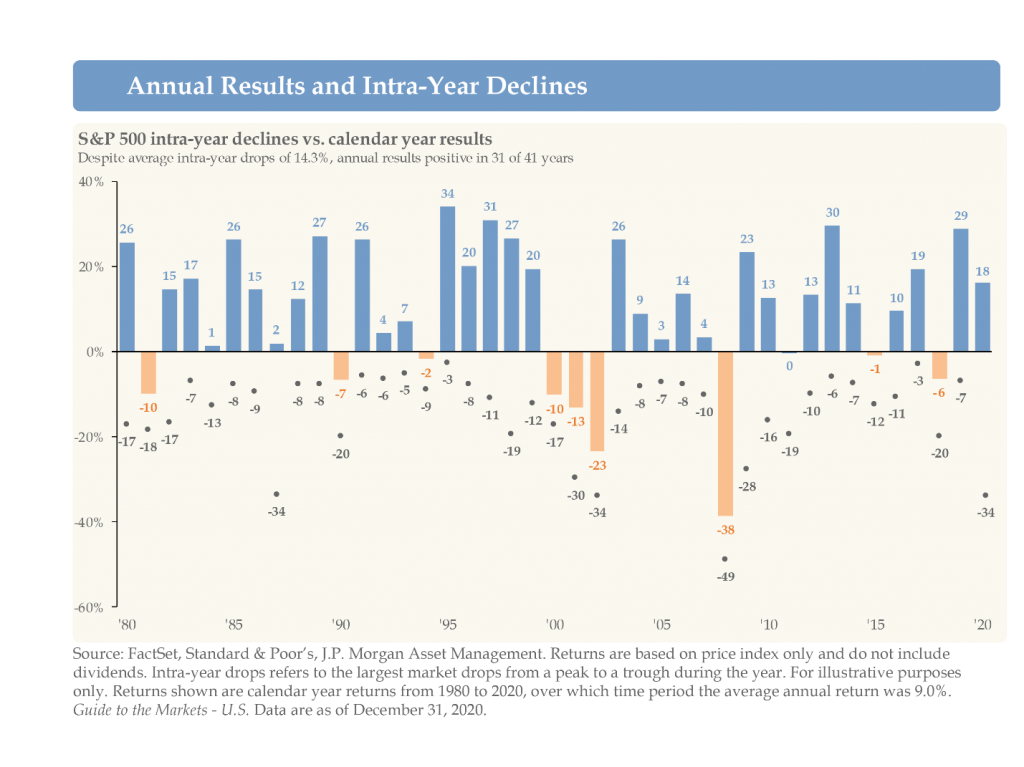

Since 1980, the average intra-year decline of the S&P 500 is 14.3%.1

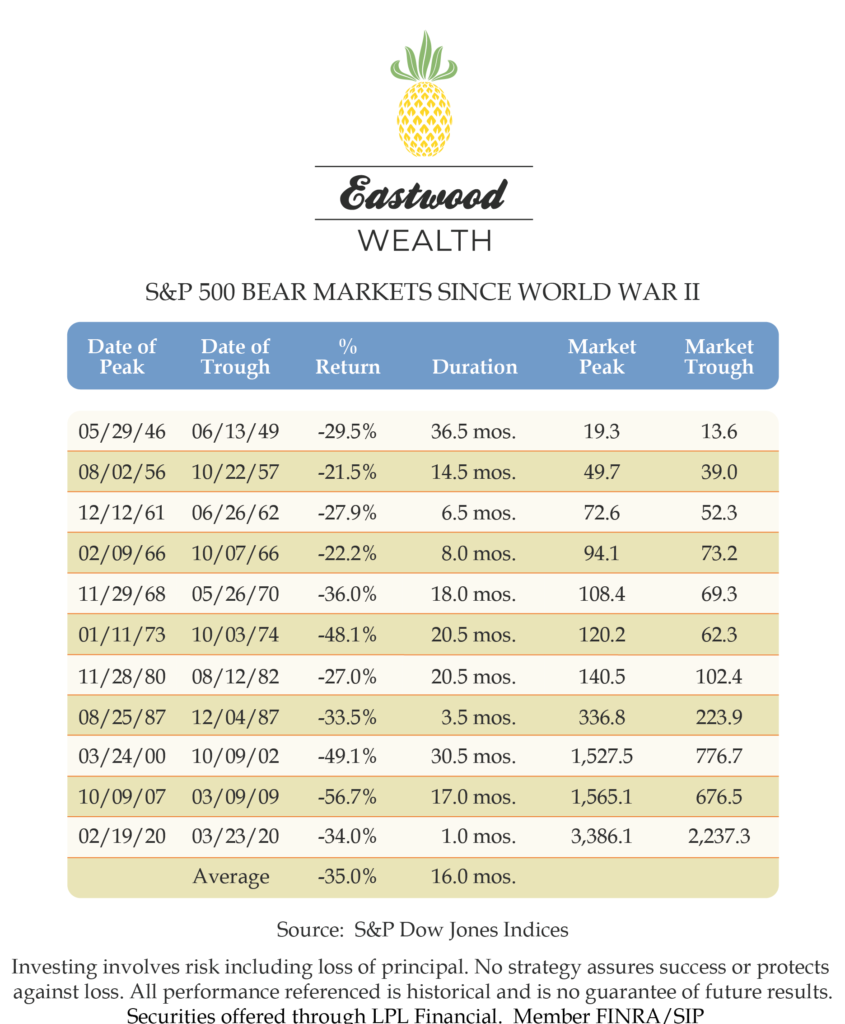

The DOW and S&P 500 receive extra attention when they decline 10% or more from a previously established record high. The media will refer to such a decline as a correction. Sometimes, a correction declines further and enters into what is known as a bear market, a 20% or more decline from a previously established record high. The term bear market gets its name from the way a bear attacks its prey, swiping its paws downward. Similarly, the bull market, an upward trending market with an absence of a 20% decline, gets its name from the way a bull attacks, thrusting its horns into the air. Both bull and bear markets are arbitrary, made-up terms and numbers so we can better understand them.

Everyone is happy and cheers bull markets and for good reason. Economies are prospering and account values are moving in the right direction. Bear markets, on the other hand, are no fun and most are accompanied with an economic recession, a significant decline in economic activity spread across the economy and lasting more than a few months. It is in the bear markets where investors can make the big mistake of letting their emotions get the best of them and sell at an inopportune time. The likes of which they may not be able to recover from down the road. Digging in to our emotional and financial reservoir of courage is essential to our long-term success while in the throes of corrections and bear markets. Let’s look at the last 75 years to draw conclusions.

Winston Churchill famously quoted, “The further back you can look, the farther forward you are likely to see.” It is worth mentioning again that bear markets are no fun, but they are a natural part of the normal business cycle and provide a wealth of perspective and framework for the future. It is also important to note that most bear markets trough, when accompanied by a recession, and start going back up three to six months before the National Bureau of Economic Research (NBER) officially gives the all clear signal that the recession has ended. In fact, over the last 80 years, stocks have bottomed on average 107 days before the end of a recession.2 Though stocks are one of the only things that people tend to not buy on sale, it is a party we want to be at when the festivities begin. For example, in the recession of 2008, the S&P 500 index bottomed in March of 2009 and was almost 60% higher when NBER announced the recession was over in September 2009. The subsequent bull market that followed the 2008 economic pullback spanned almost 11 years and grew the S&P 500 index by over 529% with dividends reinvested, peaking on February 19, 2020.3 The stock market is a leading, not lagging, economic indicator. For this reason, stock prices adjust down before issues arise on Main Street and they go up while Main Street is still feeling pain.

We are sure to encounter the bear and a recession in the future as they typically occur every seven years on average though time does not define it. Excess such as overborrowing, overbuilding and overconsuming usually initiates economic pullbacks. This is why designing and implementing a financial plan is so important as it accounts for such events that, almost always, arrive unannounced. A financial plan will provide the necessary downside protection and properly allocate our resources to match our visions and goals with our long-term needs. Once the plan is in place, we can relax and allow the aspects of the plan that we have no control over to work themselves out over time. No one knows exactly how that will happen, but it always has a unique way of doing so.

Long-term or lifetime financial plans do not change due to short-term financial market moves or current events. Plans are driven by well thought out visions, goals and history not headlines. After all, a company’s stock price is calculated by a simple equation: how much money is the company earning multiplied by a factor of what an investor is willing to pay for those earnings. When the amount of money a company earns goes up or the likelihood of that happening occurs, investors are willing to pay more to own a piece of that business causing the company’s stock price to go up and vice versa. It is important to note here that company earnings are released four times a year though executive leadership may provide interim guidance.

In the chart below, the blue and peach bars are the final, year-end results for the S&P 500, from 1980 to 2020, while the corresponding black dots show the intra-year range. For example, in 2020, the S&P 500 declined as much as 34%, from a peak to a trough during the year, while finishing the calendar year up 18%. In 2018, the S&P 500 declined as much as 20%, from a peak to a trough, during the year, while finishing the calendar year down 6%. As you can see, there is considerable movement every year with an average intra-year decline of 14.3%. Despite this, the S&P 500 averaged 9.0% per year from 1980-2020. Patience is a virtue as the ups and downs tend to smooth themselves out over time.

The Law of 72 states that you can divide the number 72 by your investment results and find the amount of years it takes your money to double. At 9.0%, your money doubles every 8 years (72/8). Behind investing equanimity, time could very well be the most critical factor in investing due to the compounding nature of money.

Compound

interest is the eighth wonder of the world. He who understands it, earns it; he

who doesn’t, pays it.

Albert Einstein

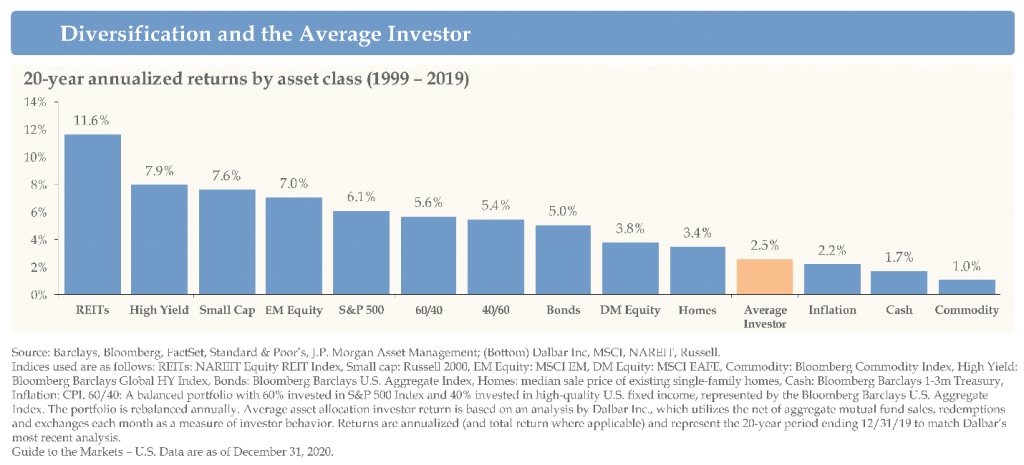

In 2002, Daniel Kahneman, PhD, a psychologist that has reportedly never taken an economics course, was awarded the Nobel Prize in Economics. He surmised that investors enjoyed better results over time by making less investment decisions. A simple theory that works extremely well in practice. In numerous studies, investor behavior is the most consistent predictor of future investment results. This idea or an unwillingness to demand more from their resources is demonstrated below as the average investor’s results are significantly less than the unmanaged, computer-driven indexes. After tax considerations and cost of living adjustments are made, the average investor’s yearly results from 1999 to 2019 were negative.

Our Main Adversary Is The Rising Costs of Goods And Services Over Time

Our most important obstacle, especially during a work optional or retirement lifestyle, is the ability of our income to keep pace with the rising cost of living over time. For example, the price of a stamp increased 267%, cumulatively, from 1980 to 2020 or compounded at 3.30% per year. In this example, $1 today will have the approximate purchasing power of $.52 in 20 years and $.38 in 30 years. At this rate, we will need to increase our income by 91% to 165% in the next 20 to 30 years to stay even with the standard of living we enjoy today. A similar type of conclusion can be drawn when measuring the increasing costs of haircuts, milk, bread, cars, homes, you name it. Historically, growth oriented investments are one of the only asset classes that can withstand these types of increases over time.

Stay The Course

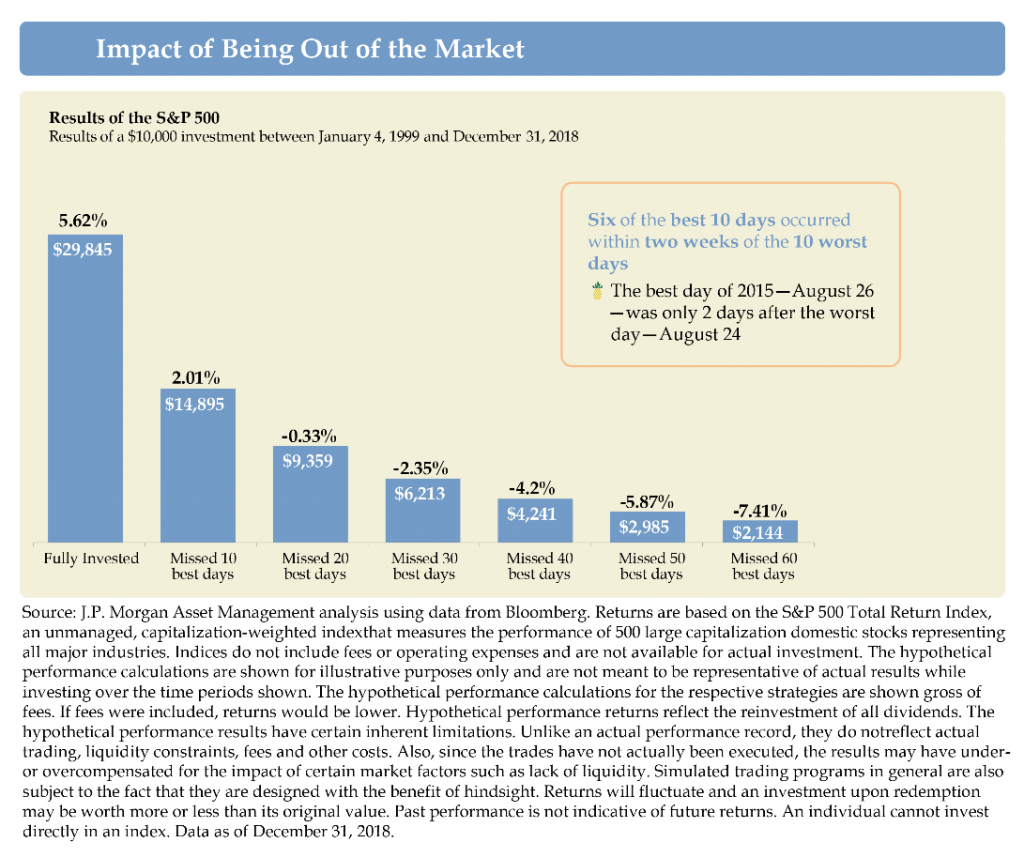

Our best interests are served by not trying to time the markets. Human nature makes us think we can, but it is virtually impossible. The dots are much easier, almost seemingly logical, to connect after an event happens, but we cannot allow ourselves to be fooled by the internal chatter of the mind. Other than being lucky, no one has ever timed the markets successfully over an extended period of time. There is too much riding on the outcome, and the chances of being incorrect are high, potentially leaving us shy of the lifestyle visions we have for ourselves and our family. Market timing of any kind is not necessary to be a successful accumulator of wealth over time, we just have to remain invested. A simple, but not easy task. The best time to invest is when we are acting on a plan and have the funds available. The best time to sell is when we are acting on a plan and need available funds. Anything less is speculating which is completely different from investing.

Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.

Peter Lynch

The only way to fully capture the enduring upside of the growth markets is to stay fully invested during the temporary declines. We have found that four of the most expensive words in investing are “this time is different.” Outside influences can form a narrative surrounding this conversation, but it has not played itself out yet. It didn’t in the Great Depression, the attack on Pearl Harbor, the many wars our country has been a part of, the internet bubble of the late 90’s, the tragedies of 9/11, the banking crisis of 2008 or the COVID-19 pandemic. Over time, it rarely matters who the President of the United States is or which party controls Congress. America always responds well, and we eventually move forward, usually sooner rather than later.

At a time when we experience swings in the financial markets, we may doubt the validity of our financial and investment plan. It is much more important to control what we can control by managing the resources we have already accumulated rather than the resources we are trying to accumulate. On the upside, we must run our own race and pursue only the lifestyle visions and goals we have for ourselves and our family’s future. It is best to leave The Joneses next door and a safe distance away. We have no control over investment results, especially those of the past. We can control and provide a cushion on the downside by having a firm grasp on our spending, removing any unnecessary expenses, enjoying a proper Emergency Fund and striving to be debt free among other items. It is not sexy, but it works. We choose to remain calm, stay focused on what matters most, control what we can control and let what we can’t control help get us to the promised land over time.

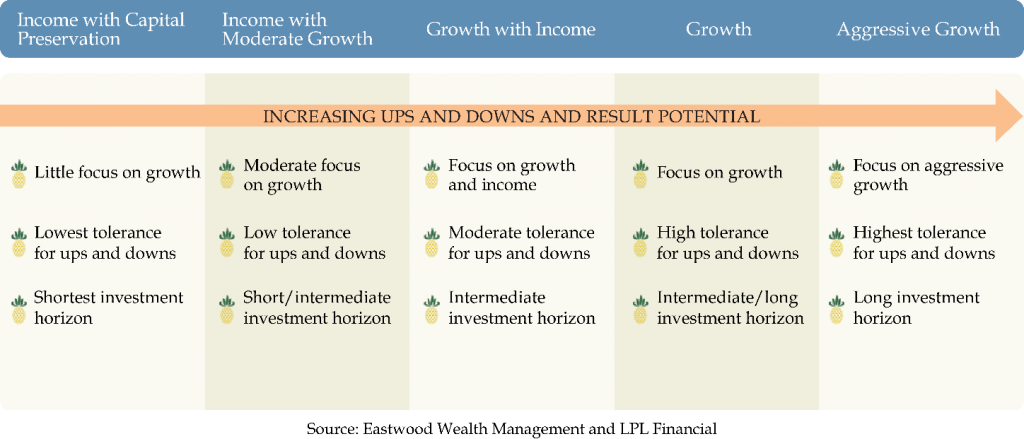

Ultimately, there are five main investment objectives and we have a repeatable process in place to determine which objective best fits our needs. Our investment objective, asset allocation and timeframe should match. If so, great! If not, let’s have a conversation.

Our advice is centered around cultivating and nurturing a lifelong relationship with you and your family through sound decision making, complete financial planning and proactive investment management to pursue optimal long-term results. During periods of economic ups and downs, we recommend remaining calm, being patient, understanding its normalcy, focusing our energy on our biggest obstacle and staying the course in a growth oriented, diversified portfolio. In other words, do little to nothing unless your visions, goals and timeframes have changed which we should talk about well in advance.

There is a difference between concern and worry. We are always concerned and encourage you to do the same without worrying. Rather, we invite you to spend time with your family and friends, do something fun or start planning the next item to check off of your bucket list. We are here holding the fort down. Our mission continues: not to insulate you from short- to intermediate-term ups and downs, but to position you in such a way to pursue and sustain the quality of life you desire for yourself and your family for a lifetime. The best way we know to do that is by encouraging you to remain goal focused and plan driven while staying the course with growth oriented investments. We empathize with you and are here for the duration.

As always, thank you for allowing us to be of service to you and your family. We always enjoy 100% open lines of communication, feel free to contact us if you have any questions or concerns.

Best,

Tim Evans CFP® CLTC

Founder

Our aim is to update the graphs annually or as they are made available. Though the numbers may vary from year to year, the spirit of the information remains the same.

1 J.P. Morgan Guide to the Markets

2Michael J. LaBella, COVID-19: Is this time really different?

3 BTN Research

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

VIEW OUR Business Continuity Plan

CFP® Certified Financial Planner™ Certified Financial Planner Board of Standards, Inc. owns the certification marks above, which it awards to individuals who successfully complete initial and ongoing certification requirements.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor Member FINRA + SIPC.

The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the Following states: NC, VA, SC, MD, DE and FL.

Financial planning services offered through LPL Financial, a registered investment advisor