March 31, 2020

I hope this finds you and your family healthy, safe and well! Last Friday, March 27th, President Trump signed what has become the largest emergency stimulus measure in our country’s history, a $2.2 trillion package aimed at helping individuals, families, businesses of all sizes and healthcare facilities impacted by the virus. Congress acted quickly with legislation to complement the Federal Reserve’s aggressive efforts on the monetary side. Nearly 900 pages in length, the Coronavirus Aid, Relief, and Economic Security (CARES) Act will be read and analyzed for weeks, months and years to come. We wanted to make you aware of the most notable provisions potentially relevant to you and your family.

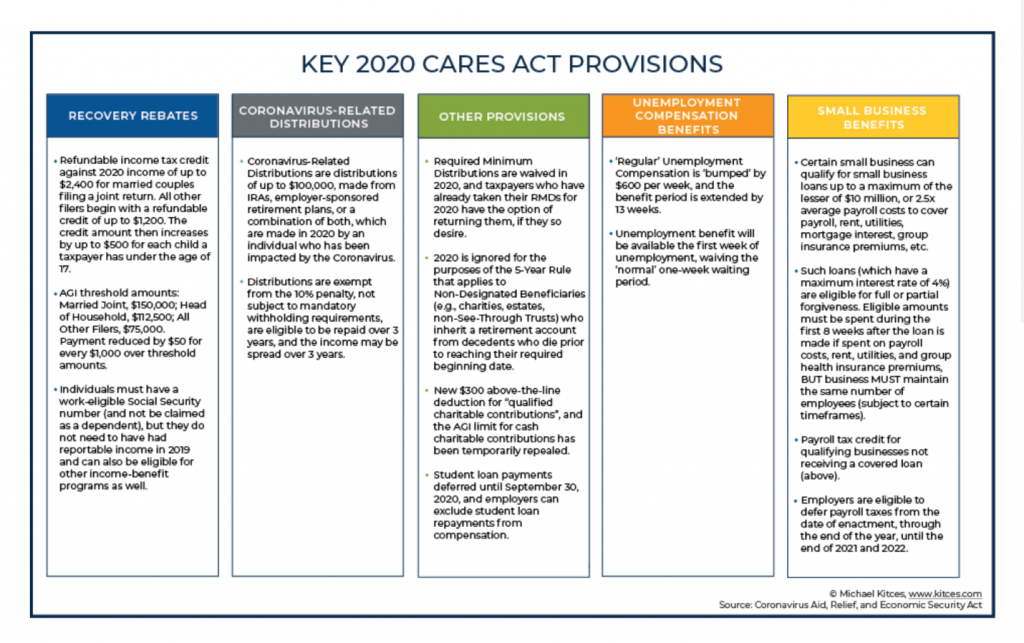

Retirement Accounts (Required Minimum Distributions)

- Required minimum distributions (RMDs) can be suspended without penalty for 2020 if you choose. This provision is broad and applies to Traditional IRAs, SEP IRAs, and SIMPLE IRAs, as well as 401(k), 403(b), and Governmental 457(b) plans.

- The relief applies to both retirement account owners as well as to beneficiaries taking stretch distributions.

- It also allows for the ability to return current-year distributions.

Retirement Accounts (Qualified Distributions and Loans)

- Coronavirus related distributions from retirement accounts of up to $100,000 are eligible for exemption from the pre-59 ½ penalty of 10%.

- Taxes related to such distributions can be spread over three tax years, and individuals have three years to roll the funds back into their IRA.

- Additionally, individuals who have been impacted by the virus may have access to enhanced loans through their employer-sponsored retirement plans.

Recovery Rebates for Individuals and Families

- Individuals will receive a one-time payment, known as a recovery rebate, of $1,200.

- Married couples will receive a one-time payment of $2,400.

- Additionally, taxpayers will receive an additional $500 for each qualified child under 17.

- The applicable Adjusted Gross Income (AGI) threshold amounts are as

follows, based on 2019 tax return, if filed; if not, 2018:

- Married filing Joint: $150,000

- Head of Household: $112,500

- Individuals and all other filers: $75,000

- For taxpayers with an AGI over $75,000, $112,500 for head of household and $150,000 married, the rebate amount is reduced $50 for each $1,000 that income exceeds the phaseout threshold. The amount will be completely phased out for single filers with incomes exceeding $99,000, $146,500 for head of household with one child, and $198,000 for joint filers with no children.

- Recovery rebates will not be taxed as income.

- The CARE Act requires that these payments be made as soon as possible. It also authorizes recovery rebate payments to be made to the account into which a taxpayer’s 2018/2019 refund was deposited. Other payments will be sent to the last known address on file.

- It appears that individuals receiving Social Security benefits will receive their recovery rebate in the same account they receive their Social Security benefits.

Business Owners

- Certain small businesses with up to 500 employees will be able to take out loans, up to $10M depending on payroll costs and other factors, which will be eligible for forgiveness if used to cover payroll and other expenses such as rent and utilities.

- If they don’t take the above loan, they may qualify for other “employee retention” tax credit opportunities.

- Other benefits for businesses include a delay in the employer’s portion of Social Security payroll tax until January 1, 2021 with half of the deferred amounts due at the end of 2021 and the other half due at the end of 2022.

- Additionally, there are more flexible Net Operating Loss rules to obtain immediate refunds, among others.

Student Loan Borrowers

- Payments are suspended until September 30, 2020

Please let us know if you have any questions or concerns, and thank you for your continued confidence. Have a great week! Take care, Tim

The content provided herein is based on our interpretation of the CARES Act and is not intended to be legal advice or provide a tax opinion. This document is a summary only and not meant to represent all provisions within the CARES Act.

VIEW OUR Business Continuity Plan

CFP® Certified Financial Planner™ Certified Financial Planner Board of Standards, Inc. owns the certification marks above, which it awards to individuals who successfully complete initial and ongoing certification requirements.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor Member FINRA + SIPC.

The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the Following states: NC, VA, SC, MD, DE and FL.

Financial planning services offered through LPL Financial, a registered investment advisor