October 9, 2020

Dear Eastwood Wealth Family,

The coronavirus is still very much with us, as is much of the economic dislocation caused by the resulting closures. It seems as if we are rapidly closing in on at least one vaccine. All the while, CDC Director Redfield says that masks may provide more protection than an eventual vaccine. So, I guess in a way we already have our best near-term solution.

I just wanted to take a moment to review what lessons we have learned or relearned, since the onset of the coronavirus panic that began in February/March and ended when the S&P 500 regained its pre-crisis highs in mid-August.

The lessons that stand out to me are:

No amount of study of economic commentary and market forecasting ever prepares us for the really dramatic events. They always just seem to come at us from left field. Trying to make investment strategy out of “expert” prognostication, much less financial journalism, always sets investors up to fail. Instead, having a long-term plan, and working that plan through all the fads and fears of an investing lifetime tend to keep us on the right path. It also helps us make sound, unemotional decisions.

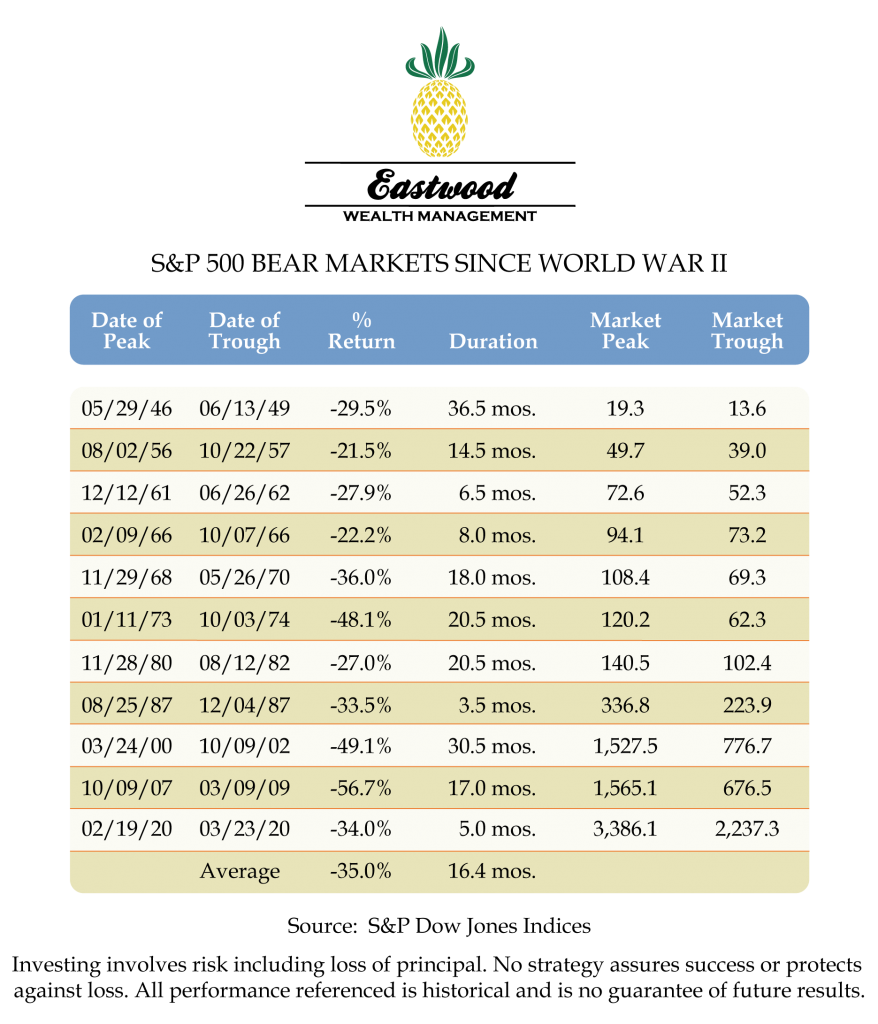

From February 19th to March 23rd, the equity market pulled back 34% in 33 calendar days. With respect to its depth, it was just about average. That is, the S&P 500 Index has declined by about a third on average every five years or so since the end of World War II. In those 75 years, the S&P 500 Index has gone from about 15 to 3,483, where it closed on October 16th. Quite the compounding effect over time. The lesson is that, at least historically, the declines haven’t lasted, and long-term progress has reasserted itself.

Almost as suddenly as the market declined, it completely recovered, surmounting its February 19th all-time high on August 18th. Note that the news concerning the virus and the economy continued to be pessimistic, even as the market came all the way back. I think there are actually two great lessons here. First, the speed and trajectory of a major market recovery very often mirror the velocity and depth of the preceding decline. Second, the equity market most often resumes its advance, and may even go into new high ground, considerably before the economic picture clears. If we wait to invest before we see favorable economic trends, history tells us that we may have missed a very significant part of the early advancement.

The overarching lesson of this year’s swift decline and rapid recovery is, of course, that the market cannot be timed. The long-term, goal-focused and diversified stock investor is best advised to just ride it out. These are the investment principles we have been following all along. If anything, our experience this year has validated our approach even further.

Now, the election. Simply stated: it is unwise to exit the quality stock funds you’ve been accumulating for your most cherished lifetime visions and goals because of the uncertainties surrounding the election. Corporations in the United States are some of the most highly evolved creatures on Earth, and they will adapt accordingly.

Aside from the self-inflicted wound of possibly incurring capital gains taxes, your chances of getting out of the market and then getting back in advantageously are historically very poor. Unfortunately, I cannot possibly be helpful to you in attempting to do so. It would simply be a guess, and we do not guess with the resources you’ve worked so hard to build. I urge you to stay the course.

Please know that I’m here to talk through any of these issues with you, and feel free to reach out anytime. As always, thank you for being part of the Eastwood Wealth Family, and we appreciate you allowing us to be a part of yours!

Best,

Tim Evans CFP® CLTC

Founder

The opinions voiced are for general information only and are not intended to provide specific advice or recommendations for any individual. All indices are unmanaged and may not be invested into directly.

VIEW OUR Business Continuity Plan

CFP® Certified Financial Planner™ Certified Financial Planner Board of Standards, Inc. owns the certification marks above, which it awards to individuals who successfully complete initial and ongoing certification requirements.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor Member FINRA + SIPC.

The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the Following states: NC, VA, SC, MD, DE and FL.

Financial planning services offered through LPL Financial, a registered investment advisor