August 16, 2022

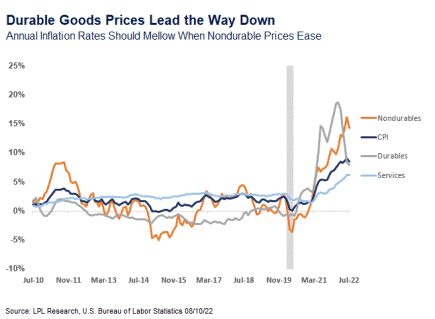

Headline CPI eased in July to 8.5% year-over-year from 9.1% in June. Still above the Federal Reserve’s (Fed) long-run target rate, the annual rate of inflation seems to be cooling. Inflation is easing as durable goods prices continue their descent from recent highs. For example, prices for appliances have declined for three out of the last four months and used vehicle prices declined four out of the last six months. “The July inflation report should change market expectations about future Fed activity,” explained Jeffrey Roach, Chief Economist for LPL Financial. “As inflation eases, the Fed can now tighten monetary policy at a slower pace.” The Fed still has a lot of work to do, but pricing pressures seem to be easing. The latest inflation report is welcomed news and could add support for the Fed to raise rates at a slower pace in September.

VIEW OUR Business Continuity Plan

CFP® Certified Financial Planner™ Certified Financial Planner Board of Standards, Inc. owns the certification marks above, which it awards to individuals who successfully complete initial and ongoing certification requirements.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor Member FINRA + SIPC.

The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the Following states: NC, VA, SC, MD, DE and FL.

Financial planning services offered through LPL Financial, a registered investment advisor