March 10, 2022

Investing in the best companies in the world has never been and will never be a straight line. It is the straightest of lines, long-term, that protects the purchasing power of our dollars. Keeping up with the increases in cost of living and sustaining or improving upon our quality of life is why we plan, save and invest our resources. If the cost of living (inflation) adjusts upward at a traditionally reasonable rate of 3% per year, one dollar today will be worth $.74 in 10 years, $.55 in 20 years and $.41 in 30 years. This is our biggest financial obstacle to overcome, and since 1802 stocks have enjoyed results of 7% per year above inflation.

For more information, please check out our Client Center at eastwoodwealth.com

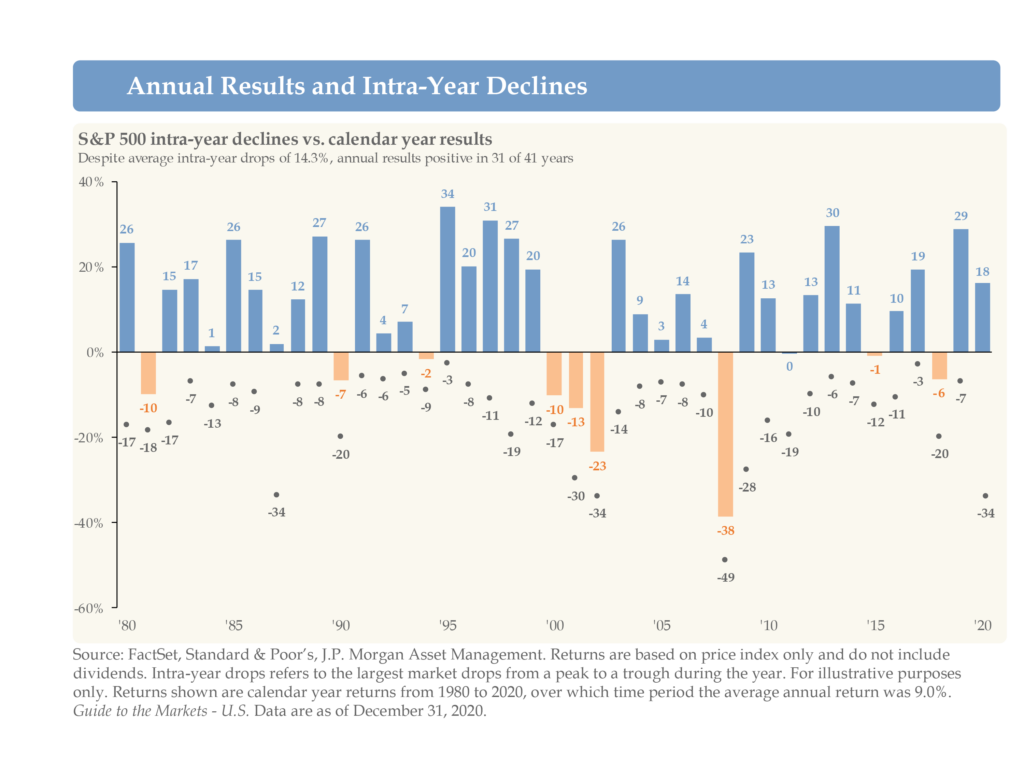

In the chart below, the blue and peach bars are the final, year-end results for the S&P 500, from 1980 to 2020, while the corresponding black dots show the intra-year range. For example, in 2020, the S&P 500 declined as much as 34%, from peak to trough during the year, while finishing the calendar year up 18%. In 2018, the S&P 500 declined as much as 20%, from a peak to a trough, during the year, while finishing the calendar year down 6%. Though 2021 is not shown on this chart, we didn’t even experience a 5% pullback last year.

As you can see, there is considerable movement every year with an average intra-year decline of 14.3%. Despite this, the average annual return of the S&P 500 was 9%. The ups and downs tend to smooth themselves out over time.

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.” Peter Lynch

When we experience movement like we have so far in 2022, I remind myself to relax and remain calm, control what I can control, be patient, remember that the ups and downs are normal, our main goal is to outpace the increases in cost of living over time and stay the course. There’s too much riding on the outcome to do anything differently.

Best,

Tim Evans, CFP® CLTC

VIEW OUR Business Continuity Plan

CFP® Certified Financial Planner™ Certified Financial Planner Board of Standards, Inc. owns the certification marks above, which it awards to individuals who successfully complete initial and ongoing certification requirements.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor Member FINRA + SIPC.

The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the Following states: NC, VA, SC, MD, DE and FL.

Financial planning services offered through LPL Financial, a registered investment advisor