May 27, 2022

“Life is like riding a bicycle. To keep your balance, you must keep moving.” – Albert Einstein

The S&P 500 Index was down more than 20% on an intraday basis on Friday, May 20th, but managed a huge rally late to avoid closing down 20% and moving into an official bear market. With the S&P 500 down 16.2%, as of the close of business on May 25, 2022, a bear market is still quite possible.

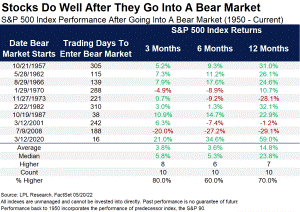

One popular question has been what happens after stocks go into a bear market? “As rough as bear markets are, the good news is the future returns really improve once stocks are down 20%,” explained LPL Financial Chief Market Strategist Ryan Detrick. “In fact, a median gain of nearly 24% a year after a bear market starts may help some beaten-down bulls confidently stay the course.”

One more look at the table above shows that only three times were stocks lower a year later and all were associated with major recessions. We do not see a recession on the horizon, which could be a clue returns could be strong going out a year.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. For more information on the risks associated with the strategies and product types discussed please visit https://lplresearch.com/Risks

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges.

All performance referenced is historical and is no guarantee of future results. Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker- dealer. Member FINRA/SIPC.

VIEW OUR Business Continuity Plan

CFP® Certified Financial Planner™ Certified Financial Planner Board of Standards, Inc. owns the certification marks above, which it awards to individuals who successfully complete initial and ongoing certification requirements.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor Member FINRA + SIPC.

The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the Following states: NC, VA, SC, MD, DE and FL.

Financial planning services offered through LPL Financial, a registered investment advisor