October 26, 2022

I hope this finds you and your family doing well!

We have talked extensively for the last couple of years about rising interest rates in our meetings and communications. 2022 is the year it has come true. So far, the Federal Reserve has raised the fed funds rate, the rate at which commercial banks borrow and lend their excess reserves to each other overnight, by 3% this year. On their path to achieve an inflation rate of around 2%, it is highly likely that they raise rates at the remaining two meetings in ’22.

The bottoming out of interest rates in March of 2020 fulfilled a cycle of downward movement that lasted roughly 40 years. As we’ve previously discussed, the next move in the financial markets is usually in the opposite direction with the same amount of velocity as the previous motion. Obviously, nothing ever moves in a straight line, but 40 years is a long time with a possible upward trajectory of interest rates.

In 1973, a bond index was created to better measure results. Today, it’s known as the Bloomberg US Aggregate Bond Index, and it’s experienced losses unlike any year since its inception. This is what happens when the federal funds rate begins the year at 0%. Interest rates go up and bond prices go down, they are inversely related.

At some point in the future, one would think the Federal Reserve will raise interest rates high enough to slow down the economy. This is why we keep hearing the term “soft landing” being offered up constantly. The Federal Reserve is trying to softly land the economy by raising interest rates to slow down inflation without feeling like the emergency brake has been pulled on the economy. It’s a difficult task.

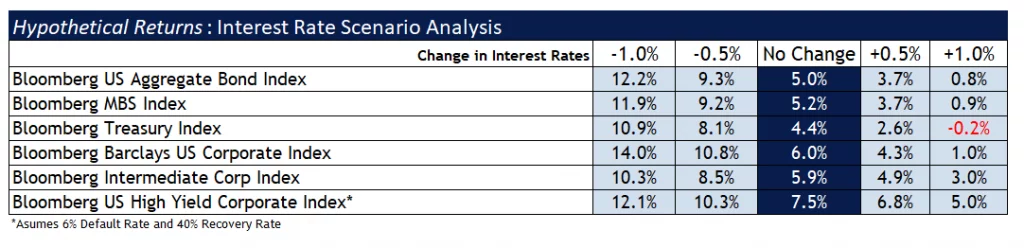

The table below provides expectations for various fixed income markets under different rate scenarios. The top two components of the US Aggregate Bond Index are U.S. Treasury bonds and securities backed by mortgage entities such as the Federal National Mortgage Association (Fannie Mae), the Government National Mortgage Association (Ginnie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac). Total government exposure in the bond index is 65%-ish.

Good financial records pertaining to the financial markets go back to 1802, when Thomas Jefferson was President. Since then, mainstream stocks have enjoyed compounded results, before being adjusted for inflation, approaching 10% per year and bonds about half of that. At this pace, $1 invested in stocks would’ve turned into over $1 billion and $1 invested in bonds over $43,000. Since 1802, stocks have averaged about 7% per year above increases in the cost of living, also known as inflation.* Owning some of the best companies in the world is a way to grow our assets over time and continue living or improve upon our quality of life.

Best,

Tim Evans, CFP® CLTC

Founder

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The Bloomberg Barclays U.S Corporate High-Yield Bond Index is an unmanaged market value weighted index composed of fixed-rate, publicly issued, non-investment grade debt.

The Bloomberg Barclays U.S. Intermediate Government/Corporate Bond Index is a market value weighted performance benchmark for government and corporate fixed-rate debt issues with maturities between one and 10 years.

The Bloomberg Barclays U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

The Bloomberg Barclays U.S. Government/Credit Index is an unmanaged market value weighted index composed of all U.S. Government and government agency securities (other than mortgage backed) that are of investment grade with maturities of one year or more.

The Bloomberg Barclays U.S. Mortgage Backed Securities Index is an unmanaged market value weighted performance benchmark that tracks mortgagebacked securities issued byGinnie Mae, Freddie Mac, and Fannie Mae with 15-year and 30-year maturities. It is a subset of the Barclays Aggregate Bond Index.

* Stocks for the Long Run 5th Edition: The Definitive Guide to Financial Market Returns and Long-Term Investment Strategies, Jeremy J. Siegel, 2014.

VIEW OUR Business Continuity Plan

CFP® Certified Financial Planner™ Certified Financial Planner Board of Standards, Inc. owns the certification marks above, which it awards to individuals who successfully complete initial and ongoing certification requirements.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor Member FINRA + SIPC.

The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the Following states: NC, VA, SC, MD, DE and FL.

Financial planning services offered through LPL Financial, a registered investment advisor