March 17, 2020

I hope this finds you and your family doing well!

Part of our communication protocol is to reach out to you when the equity markets enter bear market status – down more than 20% at closing from a previously established high. We did that near the end of last week on both the Dow Jones Industrial Average and the S&P 500. You will note that we sent a similar communication when we entered correction territory (down 10%) on February 28th. The S&P 500 needed only 16 days to go from a new all-time high, on February 19th, to a bear market, resetting the previous record of 28 days.

You may be wondering why it’s called a bear market. The term bear market gets its name from the way a bear attacks its prey, swiping its paws downward. Similarly, the bull market, an upward trending market with an absence of a 20% decline, gets its name from the way a bull attacks, thrusting its horns into the air. The present bear market brought to an end the longest bull market in history at just over 11 years, almost to the day. And here’s the kicker… both bull and bear markets are arbitrary, made-up numbers to fit nicely in a box so we can understand them. To me, the decline we experienced from September to December of 2018, down 19.8%, sure felt like a bear market, although it did not technically qualify. And, neither did April to December of 2011, when the equity markets fell 19.4%. At this point, the definitions are irrelevant. The fact is the markets are down and so are our accounts.

At times like these, the news can become addictive and filled with almost exclusively negative headlines. The media purposely uses words that trigger the fight or flight response to keep us watching. So far, the largest single-day decline was on Thursday, March 12th. On that day, I personally saw headlines that included the words: obliterate, spooks, crater, plunge, and scary. On up days they use words such as soar, surge and rally. See what I mean? As a matter of fact, on my visit to the New York Stock Exchange last October, I noticed credentialed media roaming the floor with cameras in a search to capture human emotion. These are the photographs we see on the nightly news, in the morning papers and in outlets in between.

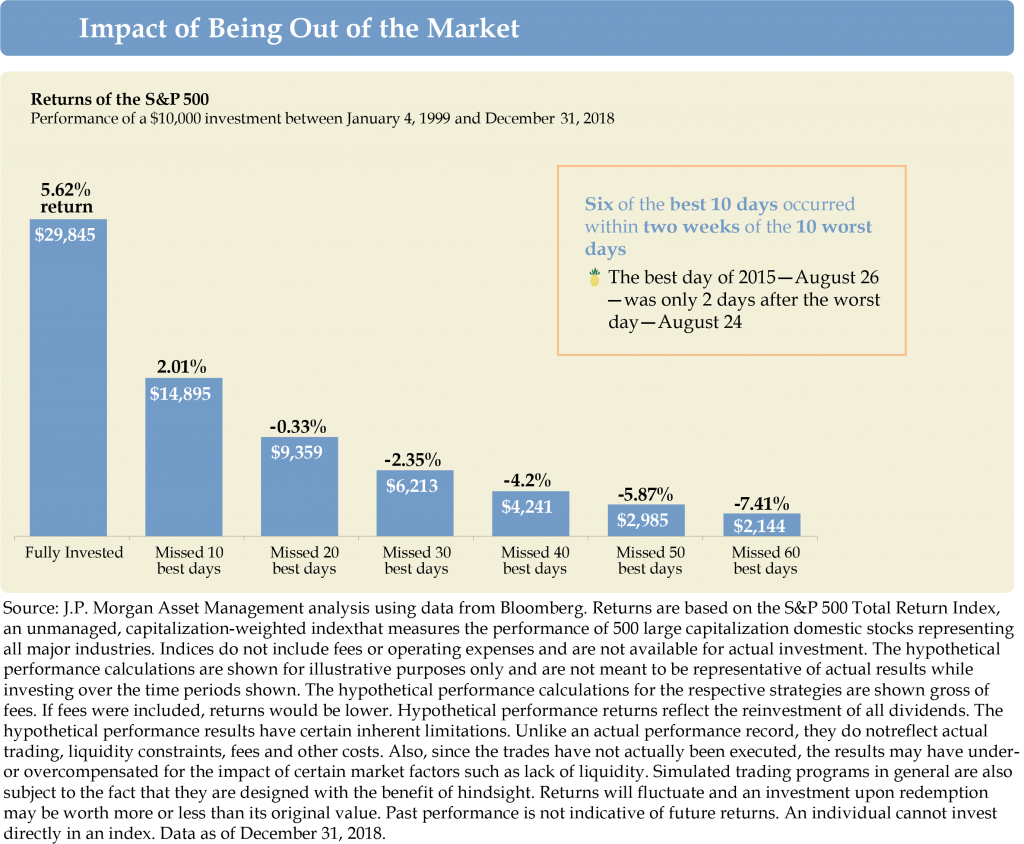

Fear, as a core human emotion, is magnified when situations arise quickly and unexpectedly. It has been the speed and unexpectedness that has driven the outsized reaction from the markets. We must remain aware of the negative headlines and the subsequent sudden urges that may follow causing us to abandon the pursuit of our long-term visions and goals. It is important to note that the best and worst days often occur very close together. For example, last Thursday’s (March 12th) precipitous move to the downside was followed on Friday, March 13th, with the best day the S&P 500 and the DOW have experienced in 12 years.1 Please review the most up-to-date graph I have that illustrates this point below.

The great news is that the U.S. economy was healthy before this three-week stretch of declines began with unemployment rates near 50-year lows, solid job and wage gains, corporate profits poised to accelerate and low interest rates. This bodes well for a faster recovery on the other side. Like someone who gets sick, the healthier you are going into it, the faster you tend to recuperate.

Historically speaking, or statistically, as of Thursday, March 12th, we were getting ever closer, within seven percent, to the average bear market decline felt since World War II of about 35%.1 I would have you receive this communication as my own increasing optimism. This optimism is simply a restatement of three of my life-long investment observations: (1) as prices decline, value increases (2) waiting for clear evidence of a market bottom ensures that you have already missed it (3) when a recovery begins its trajectory, it tends to mirror that of the previous decline’s velocity. These are historical observations, not predictions.

Based on the previously mentioned observations, my conviction remains that this time is no different. The ups and downs that we have experienced are part of the stock market’s process to find a bottom, consolidate itself, and move forward again. This doesn’t mean that stocks can’t go lower. It just means the opportunity for long-term investors is attractive. I am reminded of Warren Buffett’s teacher, Benjamin Graham and his quote, “In the short-run, the market is a voting machine, but in the long-run, it is a weighing machine.” Times like these are when we earn the historically superior results that come from owning some of the best companies in the world. We need to stay the course as this too shall pass. In an effort to communicate with you expeditiously, I invite you to visit www.EastwoodWealth.com to read Our Blog or connect with us on social media through YouTube, Twitter, LinkedIn and Facebook (On Facebook, click the thumbs up Like button from the link) for our most up-to-date communications.

In closing, our office has been structured for years now to work remotely with no interruption in Client experience. We are currently testing technologies that enable us to conduct Client meetings without having to be in the same physical space. Our Business Continuity Plan is tested annually and can be found in the disclosure area at www.EastwoodWealth.com, and we are constantly searching for ways to serve you better. I have full conviction that we are following the right path and am always here when you need me. Thank you for your continued confidence. Please stay safe and take care of yourself and your family. Thank you, Tim

1SP500 and Dow Jones Industrial Average Indices

VIEW OUR Business Continuity Plan

CFP® Certified Financial Planner™ Certified Financial Planner Board of Standards, Inc. owns the certification marks above, which it awards to individuals who successfully complete initial and ongoing certification requirements.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor Member FINRA + SIPC.

The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the Following states: NC, VA, SC, MD, DE and FL.

Financial planning services offered through LPL Financial, a registered investment advisor