March 24, 2020

I hope this finds you and your family safe, healthy and doing well! Wow! How much our lives have changed in a little over a month. Not too terribly long ago we were celebrating Punxsutawney Phil not seeing his shadow and the potential early onset of Spring. Now, we’re celebrating the warmer weather being ushered in as hopefully another arrow in our quiver to help to eradicate a virus that started across the world in Wuhan, China.

Today, the virus has made itself to over 184 countries, and we are in a global, all hands on deck. We continue to work together to minimize the virus’s impact while the healthcare community works feverishly on pharmaceuticals to lessen the severity after onset and a vaccine. In the interim, global economic growth has slowed and economies are contracting. Consequently, significant ebbing and flowing have become the norm in the equity markets, especially to the downside. Interest rates have seen all-time lows making borrowing less expensive and challenging savers. In short, this has been a tough period for many of us long-term investors.

Despite elevated uncertainty, we are encouraged by the actions of global central banks and governments to support their economies and financial markets. In the United States, the Federal Reserve lowered the Fed Funds rate by a full percentage point on Sunday, March 15th allowing it to operate in a target range of 0–0.25%. The full impact of lower rates may have to wait until loan demand picks up, but other Fed actions may provide more immediate support to help financial markets continue to run smoothly, bolster short-term funding and increase liquidity. At the same time, the U.S. government has already passed several measures to support the economy and is currently working on a major stimulus package.

It can be difficult to keep looking ahead with so much uncertainty and so many unanswered questions. We wouldn’t be human if we felt differently. I have found it important to understand that from a financial planning and investment standpoint the equity market will find an eventual bottom and start its ascent long before the economic data is attractive.

In The Great Recession of 2008, the S&P 500 (500 large companies in U.S.) bottomed on March 9, 2009 at 676.531. The National Bureau of Economic Research released on September 20th of ‘09 that the U.S. economy had exited recessionary status in June. When the coast is clear announcement came, the S&P 500 was at 1,068.291, an increase of 57.90% in a little over six months without considering the reinvestment of any dividends. By the time, the longest bull market in history, 11 years almost to the day, finished running on March 11, 2020, the cumulative gains were over 400% from the bottom. The patient and disciplined long-term investor was rewarded for remaining steadfast in the face of great uncertainty. We find ourselves in similar territory again. The markets are forward looking, and we need to be too.

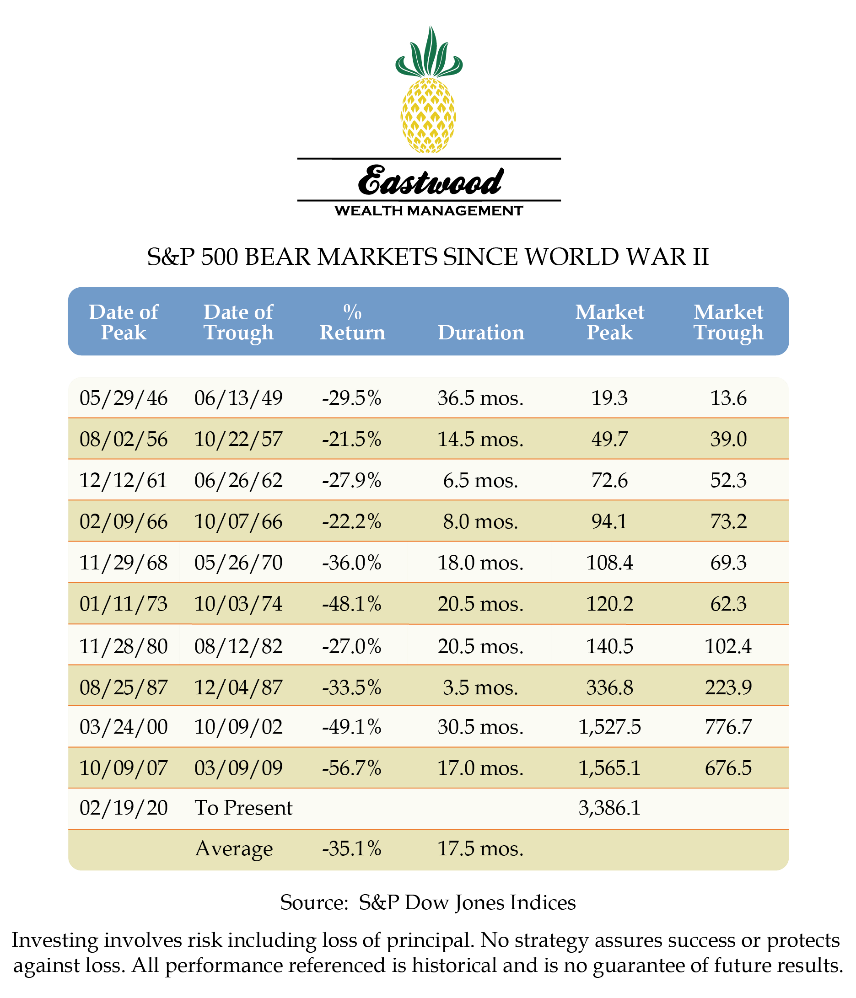

Please review the chart above as it represents the last 74 years of bear markets. As of the close of business on March 23, 2020, the S&P 500 had declined 33.9%1 from its closing peak attained on February 19, 2020. You will notice the average bear market decline since the end of World War II is 35.1% lasting 17.5 months.

For lack of clairvoyance, I do not know where the bottom will be or how long it will last in this or any other decline. I wish I did. The fact is no one knows, if they’re telling you the truth. Here’s what I do know: the advice we have rendered throughout the years is time tested, long-term strategic in nature and was shared to prepare us for times exactly like what we are experiencing. While most triggering events in economic downturns are different, the financial planning and investing playbook remains the same or very similar. We stay focused on what matters most, we control what we can control, expend as little energy as possible on those things outside of our control and tighten up the laces on our Air Jordan’s until the dust settles.

In closing, please review our Retirement Rules of the Road again at your leisure as several of the points made are important as I write. These guidelines came about years ago as I found myself providing the same advice Client meeting after Client meeting. A leave behind to ponder in the quiet times and a roadmap as such. There are always exceptions to the rule and for those of us pursuing careers, the spirit of the points shared remain the same though the amount required in our Emergency Fund may not be as large, three to six months’ worth of living expenses preferably closer to six in most cases. I know, this is not fun or sexy cocktail talk and could even feel like I’m asking you to eat your greens. Here’s the thing: outside of a health event, accident or behavioral investing mistake our probability of becoming financially independent increases significantly by following just a few simple, but not easy steps. We can do this!

I feel so fortunate to be doing my life’s work and believe one of my biggest responsibilities is to prevent Clients from making decisions they may later regret. We must stay the course. Though these times are not fun, I cannot express with words the fulfillment I feel inside to be of service to you and your family at this very point in time as we navigate these waters together. Thank you, your confidence is greatly appreciated. If you ever need me before you hear from me, please reach out anytime as we enjoy 100% open lines of communication. Be safe, take care and I’ll check in again soon! Best, Tim

1S&P Dow Jones Indices

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All indices are unmanaged and may not be invested into directly.

VIEW OUR Business Continuity Plan

CFP® Certified Financial Planner™ Certified Financial Planner Board of Standards, Inc. owns the certification marks above, which it awards to individuals who successfully complete initial and ongoing certification requirements.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor Member FINRA + SIPC.

The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the Following states: NC, VA, SC, MD, DE and FL.

Financial planning services offered through LPL Financial, a registered investment advisor