October 25, 2021

The digital revolution began in the mid-20th century as computers changed the landscape of how business was conducted. The long-established Industrial Age ways that started in 1760 in Great Britain were replaced by the Information Age. Eventually, the Information Age will give way to the next iteration of major global expansion.

We live in a fast pace, 24 hour, seven days a week news cycle. The lines of what is news are often blurred by theatrical performance. The same stories are reported 180 degrees apart depending upon where we get our information. The most polarizing and divisive is political journalism. When combined with financial journalism, these two areas can be a recipe to significantly disrupt our pursuit of financial independence. Under the guise of keeping us informed, overabundance is often sold on the upside and scarcity on the downside. Both lead to fear-based planning which rarely ends well for individuals, families and business owners.

At Eastwood Wealth, we make financial planning and investment management decisions based on long standing, time tested principles that have been around for centuries and, in many cases, thousands of years. We invite you to examine the facts and let the dots connect themselves.

The New York Stock Exchange, which it is now commonly referred, was officially founded on May 17, 1792 with the signing of the Buttonwood Agreement. Appropriately named, it was signed by twenty-four of New York’s leading merchants under a buttonwood tree on Wall Street in Lower Manhattan. The agreement provided a foundation for trading and fair compensation for services to level the playing field for everyone.

The original signed Buttonwood Agreement on display at the New York Stock Exchange

Good records pertaining to the financial markets go back to 1802, when Thomas Jefferson was President. Since then, mainstream stocks have enjoyed compounded results, before being adjusted for inflation, approaching 10% per year and bonds about half of that. At this pace since 1802, $1 invested in stocks would turn into over $1 billion and over $43,000 in bonds. Since 1802, stocks have averaged about 7% per year above increases in the cost of living, also known as inflation. Owning stocks is a way to grow our assets over time and continue living or improve upon our quality of life.

George Washington took the oath of office as our first President on April 30, 1789, and we have had 45 Presidents since. To govern effectively, Presidents need help from Congress, which consists of 100 members in the Senate and 435 in the House of Representatives, and vice versa.

Regarding diversified stock fund investing over the long term, what if it didn’t matter who the President of the United States was or what party they represented? What if it had more to do with business cycles, generational spending cycles, breakthrough technologies and events outside of those controlling government just to name a few? There is only so much one person or groups of people, whether Republican or Democrat, can do before their terms are up or they face reelection.

What if our pursuit of financial independence had more to do with what we can control than what we cannot? What if, through all the ups and downs that come along with life, all we had to do was stay the course with our growth-oriented investments for the rest of our life and pass that knowledge forward to positively change our family’s financial tree and countless others? What if, rather than human beings, we have become human doings and are making things more complex than they need to be? What if, rather than worrying, we were able to spend more time living a long and healthy, purpose-filled life surrounded by the people, places and activities we love the most? Outside of an unforeseen health event or an accident, our Retirement Rules of the Road illuminate a path to do so.

Corporations in the United States may be the most highly evolved creatures on Earth. They adapt quickly, efficiently and are laser focused on the future. While each triggering event causing the markets to move is different, our playbook is very similar or the same. We hold steadfast that owning some of the best companies in the world through diversified stock funds, whether the market is up, down or sideways, is one of the only ways to fully capture the continuous growth of human innovation and ingenuity.

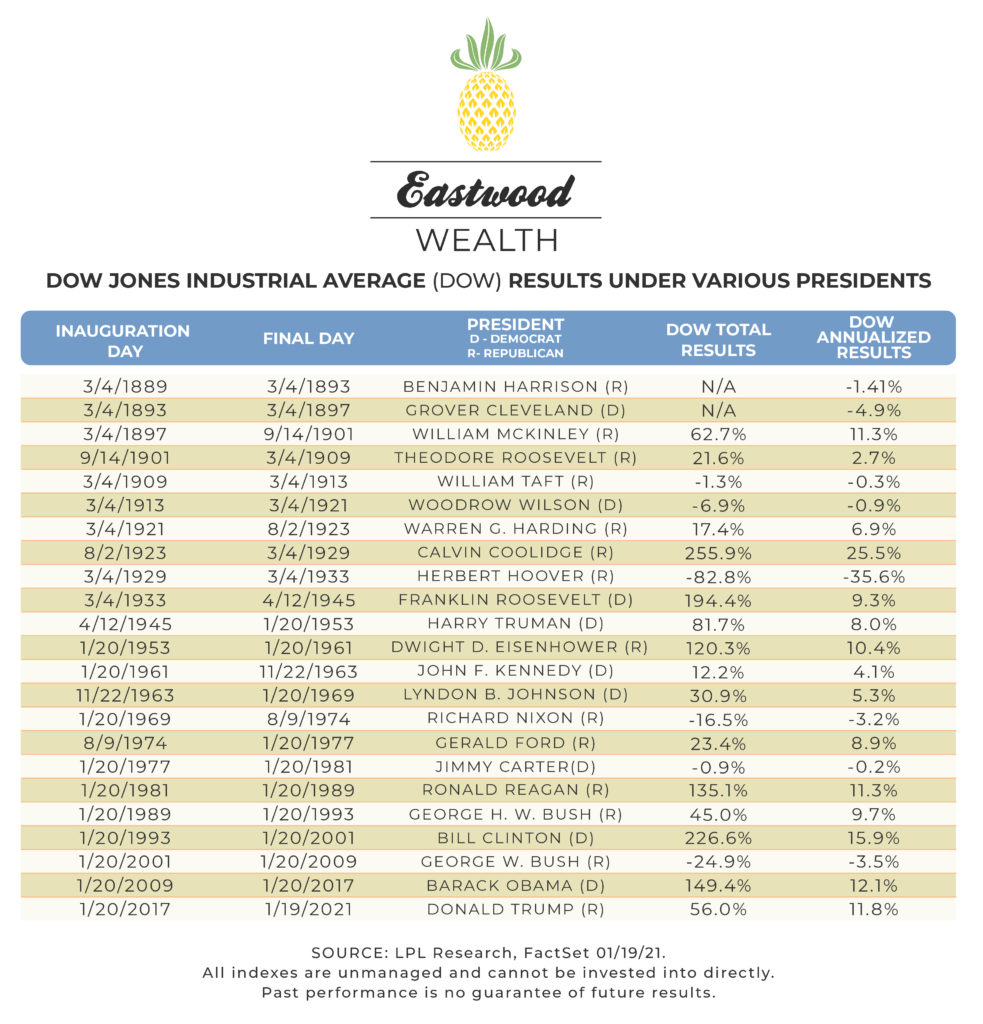

Below, we share stock market results under Presidents dating back to 1889. You will see that our nation’s leaders have faced and dealt with their share of crises over the years. All the while, our country consistently moves forward, and the trajectory of stocks is up and to the right. In other words, the downs are temporary and the ups are permanent.

Our research uses the DOW Jones Industrial Average and the S&P 500 to draw conclusions. The DOW was originally published as in index on May 26, 1896. Today, the DOW is made up of 30 prominent companies in the United States. The S&P 500 consists of the top 505 publicly traded companies in the United States. The S&P 500 was introduced in 1957 and it can be tracked back to the late 1920s.

First, we share a graphic on how the DOW has fared under each President since 1889. Next, we combine the two indexes, using the DOW up to President Hoover and continuing with the S&P 500 through President Trump, and add additional commentary to provide more insight.

The results below do not include dividends and data is not adjusted for inflation. Though very similar, you may find minor discrepancies between the two comparisons due to this and the S&P 500 index being used after President Coolidge. Presidents are listed in order based on stock market results during their time in office.

#1 of 23

President Calvin Coolidge, Republican

- Market Results: 26.1% per year

- Term: August 2, 1923 – March 4, 1929

- Election Year: 1924

The best President as measured by annual results, was so far out in front it will make you look again. President Calvin Coolidge saw average annual returns of 26.1% during his time in office.

President Coolidge presided over the boom years called the Roaring Twenties. He left office just as the party was ending, about six months before the Great Crash of 1929 ushered in the Great Depression.

#2 of 23

President Bill Clinton, Democrat

- Market Results: 15.2% per year

- Term: January 20, 1993 – January 20, 2001

- Election Year: 1992 and 1996

President Bill Clinton presided over one of the most exciting and longest bull markets in history. Fueled by the dot-com boom of the 90s, investors saw the emergence of the internet and new technology companies that fundamentally reshaped the U.S. and world economies.

With gains in seven of the eight years during the Clinton presidency (2000 saw the S&P 500 go down by 9.1%), there was a five-year run from 1995 to 1999 that saw annual returns of 37.2%, 22.7%, 33.0%, 28.6% and 21.0%.

#3 of 23

President Barak Obama, Democrat

- Market Results: 13.8% per year

- Term: January 20, 2009 – January 20, 2017

- Election Year: 2008 and 2012

President Barack Obama took office during the Great Recession, which officially lasted from December 2007 until June 2009. The Great Recession was fueled by numerous events such as the housing bubble in 2006 and 2007, followed by the subprime mortgage crisis in 2007 and 2008. This hit American households and the financial sectors of the economy especially hard. One of President Obama’s first acts was signing the American Recovery and Reinvestment Act of 2009 that aimed to help the country come out of its deepening recession.

Critics will suggest that President Obama benefited from timing, as he took office just as the Great Recession was nearing its end. Ultimately, he enjoyed positive returns for the S&P 500 during every year of his presidency with six of the eight in double digits.

#4 of 23

President Donald Trump, Republican

- Market Results: 13.7% per year

- Term: January 20, 2017- January 20, 2021

- Election Year: 2016

President Trump is one of only five Presidents ever elected to never have been elected to public office before. During his campaign, he vowed to Make America Great Again by putting America first and bolstering the economy.

He installed three Supreme Court justices, established the sixth branch of the US Armed Forces, Space Force, successfully passed tax reform and presided over strong economic growth.

He led the country through the COVID-19 pandemic in which he himself tested positive for while in office. He is also the first President to ever be impeached twice.

#5 of 23

President William McKinley, Republican

- Market Results: 11.3% per year

- Term: March 4, 1897 – September 14, 1901

- Election Year: 1896 and 1900

Most of the Presidents with the highest results are from more recent times, but McKinley’s Presidency was known as a time of rapid growth in the United States.

Many historians will suggest that investors enjoyed lofty returns during President McKinley’s two terms, which were cut short by his assassination in 1901, due to the devastating depression that ended prior to his election. His domestic policies favored American manufacturers and factory workers as he passed the 1897 Dingley Act and the Gold Standard Act.

#6 of 23

President George H.W. Bush, Republican

- Market Results: 11.0% per year

- Term: January 20, 1989 – January 20, 1993

- Election Year: 1988

While the elder George Bush only served one term, his Presidency was among the best for stocks. Many historians suggest that President Bush inherited a soaring stock market and booming economy from Ronald Regan.

The U.S. economy was performing well since the recession in 1982, but it did slip into another recession in 1990. During this time, unemployment went from 6% to close to 8% and the federal deficit increased dramatically, tripling since the early 80’s.

#7 of 23

President Dwight D. Eisenhower, Republican

- Market Results: 10.9% per year

- Term: January 20, 1953 – January 20, 1961

- Election Year: 1952 and 1956

Dwight D. Eisenhower, known as Ike, became a 5-star General in the Army and served as the Supreme Commander of the Allied Forces in Europe during World War II.

Eisenhower presided over many firsts, including the establishment of NASA, the Interstate Highway System and the signing of the Civil Rights Act of 1957. But economically, his policies encouraged the booming U.S. economy as the U.S. was the only major world superpower to emerge from World War II without significant rebuilding needs.

Despite presiding over the Recession of 1958, the S&P 500 recorded an annual gain of 10.9% each year.

#8 of 23

President Gerald Ford, Republican

- Market Results: 10.8% per year

- Term: August 9, 1974 – January 20, 1977

- Election Year: N/A

President Ford was never actually elected Vice President or President, as he took over as vice president for the resigning Spiro Agnew and later took over when President Nixon resigned.

President Ford took over during high inflation and slow growth times and at the end of the 1973-1974 bear market which pushed down the S&P 500 and DOW by about half.

Economic historians generally credit the 10.8% annualized market results during the Ford years to the fact that the market was coming off economic lows versus anything President Ford did or didn’t do.

#9 of 23

President Ronald Reagan, Republican

- Market Results: 10.2% per year

- Term: January 20, 1981 – January 20, 1989

- Election Year: 1980 and 1984

During President Reagan’s term, the economy sped up its transition from industrial to technology as one of the greatest bull markets in history took root.

President Reagan’s economic policies, known as Reaganomics, were pro tax cuts, government deregulation, less government spending and pro-business.

Reagan came into office with inflation running high and his Fed Chairman, Paul Volker, is generally credited with taming inflation with tight monetary policy. The resulting policies helped reduce inflation from 12.5% to 4.4% and bring real GDP, the total monetary or market value of all the finished goods and services produced within a country’s borders during a specific period of time, to an annual growth rate of 3.6%.

When he left office in 1989, his approval rating was 68%, among the highest of any President. His 10.2% annualized results during his presidency surely had something to do with that.

#10 of 23

President Harry S. Truman, Democrat

- Market Results: 8.1% per year

- Term: April 12, 1945 – January 20, 1953

- Election Year: 1944 and 1948

President Truman ascended to the Presidency after the death of President Franklin Roosevelt. He is best known for ending World War II with the atomic bombs on Hiroshima and Nagasaki, the Marshall Plan which helped rebuild Western Europe and leading the U.S. into the Korean War.

Domestically, Truman’s presidency oversaw the start of the post-World War II surge in U.S. prosperity.

#11 of 23

President Lyndon B. Johnson, Democrat

- Market Results: 7.7% per year

- Term: November 22, 1963 – January 20, 1969

- Election Year: N/A

Known as LBJ, Lyndon Johnson assumed the presidency following the assassination of President Kennedy. His presidency is most often remembered for the escalation of the Vietnam War and significant social unrest throughout the country.

President Johnson is generally ranked favorably by many economic historians for his domestic policies, including his War on Poverty efforts, expansion of civil rights, and the establishment of Medicare and Medicaid.

The stock market turned in a healthy 7.7% per year results under President Johnson. The cost of the Vietnam War caused inflation to move higher which eventually led to high inflation, low growth, and high unemployment known as stagflation.

#12 of 23

President Warren G. Harding, Republican

- Market Results: 6.9% per year

- Term: March 4, 1921 – August 2, 1923

- Election Year: 1920

At the time of his presidency, Harding was very popular, but after his death, his administration’s scandals came to light, including the Teapot Dome bribery scandal, considered one of the biggest political scandals of all time.

When Harding took office in 1921, the country was in the midst of a postwar economic decline and Harding’s plan was to reduce income taxes, increase tariffs to protect American farmers and support the build-out of America’s highway system.

Harding died about half-way through his term from a heart attack.

#13 of 23

President Jimmy Carter, Democrat

- Market Results: 6.9% per year

- Term: January 20, 1977 – January 20, 1981

- Election Year: 1976

President Carter is probably best known for what he did before and after he was president. His peanut farmer label before becoming president and his heroic human rights work post-presidency are well documented. Often regarded as one of the smartest presidents of all time, the economic conditions of his Presidency were besieged by low growth and high inflation.

During Carter’s term in office, he presided over the launch of the Department of Energy and the Department of Education. The last few years of his single-term presidency were marked by the Iran hostage crisis and the 1979 Energy Crisis.

#14 of 23

President John F. Kennedy, Democrat

- Market Results: 6.5% per year

- Term: January 20, 1961 – November 22, 1963

- Election Year: 1960

John F. Kennedy tragically did not finish his term as his assassination occurred less than three years into his presidency.

President Kennedy is best known for presiding over the establishment of the Peace Corps, his handling of the Cuban Missile Crisis and inspiring Americans to fly to the moon. He advocated that lower personal and corporate income taxes would stimulate more overall economic activity, a notion coined the Laffer Curve which was later adopted during President Reagan’s time in office.

Kennedy did preside over a brief six month bear market from December 1961 to June 1962 that saw the S&P 500 go down by 28% or the 6.5% per year results during his Presidency would have been higher.

#15 of 23

President Franklin Delano Roosevelt, Democrat

- Market Results: 6.2% per year

- Term: March 4, 1933 – April 12, 1945

- Election Year: 1932, 1936, 1940 and 1944

FDR has the distinction of being the longest-serving President in U.S. history, having been elected to four consecutive terms. He served a little more than 12 years before dying in office.

Roosevelt took office in the middle of the Great Depression and within 100 days he helped push through massive federal legislation that kicked off the New Deal, which were federal programs designed to provide Americans help from the worst economic period in our country’s history.

Roosevelt is credited with speaking directly to all Americans with his fireside chat radio addresses and was the first president on television. President Roosevelt spearheaded numerous programs for the unemployed, assisted farmers and helped bring an end to Prohibition. Other major programs implemented under Roosevelt include the Securities and Exchange Commission, the National Labor Relations Act, the Federal Deposit Insurance Corporation and Social Security.

While the U.S. economy improved significantly in the first three years after the Great Depression, a deep recession engulfed the country in 1937 and 1938, which explains the 6.2% per year results of stocks under President Roosevelt.

#16 of 23

President Woodrow Wilson, Democrat

- Market Results: 3.1% per year

- Term: March 4, 1913 – March 4, 1921

- Election Year: 1912 and 1916

President Woodrow Wilson brought back federal income taxes and created what eventually became the Internal Revenue Service. He also introduced the Federal Reserve System. To find out more about how the Federal Reserve was created, click HERE.

In addition, on April 2, 1917, Wilson led the country into World War I.

#17 of 23

President Theodore Roosevelt, Republican

- Market Results: 2.2% per year

- Term: Sept. 14, 1901 – March 4, 1909

- Election Year: 1900 and 1904

Teddy Roosevelt became the youngest President ever after President McKinley was assassinated.

One of America’s more colorful Presidents, Roosevelt could also be confrontational and controversial as he fully embraced his Rough Rider cowboy brand whenever he could.

President Roosevelt also continued breaking up companies by bringing lawsuits under the Sherman Antitrust Act and helped launch the Department of Commerce and Labor.

#18 of 23

President William Howard Taft, Republican

- Market Results: -0.1% per year

- Term: March 4, 1909 – March 4, 1913

- Election Year: 1908

President Taft was another one-term President. And, besides his interesting mustache, Taft was the only person to ever serve as President and Chief Justice of the Supreme Court.

President Taft pushed for more businesses to be broken up through lawsuits brought under the Sherman Antitrust Act, including suits against Standard Oil, American Tobacco and U.S. Steel.

#19 of 24

President Benjamin Harrison, Republican

- Market Results: -1.4% per year

- Term: March 4, 1889 – March 4, 1893

- Election Year: 1888

President Benjamin Harrison was the grandson of President William Henry Harrison, which makes those two the only grandfather-grandson pair to have lived in the White House.

Under President Harrison’s watch, the federal budget passed the $1 billion threshold. In comparison, the 2022 budget forwarded by President Joe Biden is over $6 trillion.

President Harrison also helped pass the McKinley Tariff, which imposed historical trade tariffs, as well as the Sherman Antitrust Act.

#20 of 23

President Richard Nixon, Republican

- Market Results: -3.9% per year

- Term: January 20, 1969 – August 9, 1974

- Election Year: 1968

President Nixon is remembered for Watergate, the Vietnam War and, ultimately, his resignation. He is also remembered for abandoning the gold standard which meant that the United States would no longer convert dollars to gold at a fixed value.

Nixon implemented a series of economic measures, now called the Nixon Shock, to help combat rising inflation. The result was even higher inflation in the 1970s and one of the worst bear markets in history from 1973 – 1974.

#21 of 23

President Grover Cleveland, Democrat

- Market Results: -4.9% per year

- Term: March 4, 1893 – March 4, 1897

- Election Year: 1892

Grover Cleveland was the 22nd and 24th president of the United States, the only president in history to serve two non-consecutive terms in office (1885 – 1889 and 1893 – 1897). But his second presidency will be remembered for the third worst in history as measured by market results.

Cleveland’s second Presidential term coincided with the Panic of 1893 that ran through 1897 and the end of Cleveland’s presidency. The Panic of 1893 began with a railroad bankruptcy in February 1893 and resulted in over 500 banks closing, more than 15,000 business failing and unemployment hitting 19%.

The deep recession that followed hammered the banking system and by many accounts led to the realignment of the Democratic Party and the beginning of the Progressive Era.

#22 of 23

President George W. Bush, Republican

- Market Results: -5.6% per year

- Term: January 20, 2001 – January 20, 2009

- Election Year: 2000 and 2004

George W. Bush came into office after the dot.com boom of the 1990s, and he presided during the September 11th terrorist attacks, the Iraq War and the 2007-2008 mortgage crisis.

While there were some good years from 2003 through 2007, investors experienced one of the worst bear markets in history stretching from October 2007 through March 2009.

During this time, the DOW, S&P 500 and NASDAQ, which tracks 3,300 mostly technology-based companies, were all down 49% or more.

#23 of 23

President Herbert Hoover, Republican

- Market Results: -30.8% per year

- Term: March 4, 1929 – March 4, 1933

- Election Year: 1928

President Hoover took office just a few months before the Stock Market Crash of 1929 which led to the worst bear market in history. Hoover presided over an annualized compound loss of 30.8% and a cumulative decline of 77.1%.

After his landslide win in 1928, Hoover said in his inaugural address that: “I have no fears for the future of our country. It is bright with hope.” Then just seven months later, on October 24, 1929, the world witnessed the beginning of the Stock Market Crash of 1929, which brought Black Monday, when the DOW declined by 13% in a single day.

The opinions expressed in this material do not necessarily reflect the views of LPL Financial.

With contributions from RSW Publishing

VIEW OUR Business Continuity Plan

CFP® Certified Financial Planner™ Certified Financial Planner Board of Standards, Inc. owns the certification marks above, which it awards to individuals who successfully complete initial and ongoing certification requirements.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor Member FINRA + SIPC.

The LPL Financial registered representative associated with this site may only discuss and/or transact securities business with residents of the Following states: NC, VA, SC, MD, DE and FL.

Financial planning services offered through LPL Financial, a registered investment advisor